A Partnership of Entrepreneurs, Operators & Investors

We seek to identify ambitious, high-potential companies and leaders where our combination of operating support and permanent capital can help power sustainable growth.

About Us

Westerly backs ambitious operators with permanent capital to build platforms within durable industries that are predisposed to a multi-decade outlook. We employ a flexible structure that allows for continual reinvestment and compounding of cash flow. Westerly provides both the initial capital to launch a new platform or the first institutional capital into an existing platform to accelerate growth.

Team of Experienced Entrepreneurs

Our founders have built and grown businesses across a range of industries.

Putting Operators First

We know our blind spots and where we can add value, and understand that A+ talent comes above all else.

Truly Permanent Capital

We never have to sell and measure returns in decades, not years.

Drivers of Value

Supply

- Increasing supply of high-quality and modestly priced small businesses

- Over 600,000 sub-institutional businesses(1), largely owned by boomers, looking to transition that can be acquired for attractive earnings multiples

Structure

- We employ a capital-efficient holding company (“Holdco”) structure within each of our platforms

- After modest upfront equity investment, pivot to funding growth through internal cash flow and debt, creating a flywheel for long-term compounding without additional equity funding

Incentives

- Align incentives around long-term Multiple of Invested Capital (“MOIC”, or share price), rather than near-term distributions

- Evergreen structure with mechanisms for management and investor liquidity in the absence of company sale

Experience

- Partner with experienced co-investors and advisors in every platform

- Utilize replicable operational playbook from inception to maturity to maximize long-term potential

Westerly Value Add

Talent

Senior management talent below the CEO is a critical barrier to scaling small businesses

Execution

Support in sourcing, diligence, structuring, financing, integration, and driving performance

Ecosystem

Leverage best practices and experience across teams within the Westerly portfolio

Investment Criteria

Team Characteristics

Ambitious Operators:

Relevant industry experience, in “middle-innings” of careers

Complementary Skillsets:

Time in the trenches, leadership, capital allocation

Career Orientation:

Multi-decade outlook, platform would be the keystone achievement of the teams we back

Business Characteristics

Enduringly Profitable:

Leaders within local markets providing critical, recurring services

Independently Owned:

Looking for a leadership transition or growth capital to reinvest

Unique Benefit from Permanent Capital:

Consistent secular tailwinds, lack of technological disruption, attractive but longer pay-back cycles, etc.

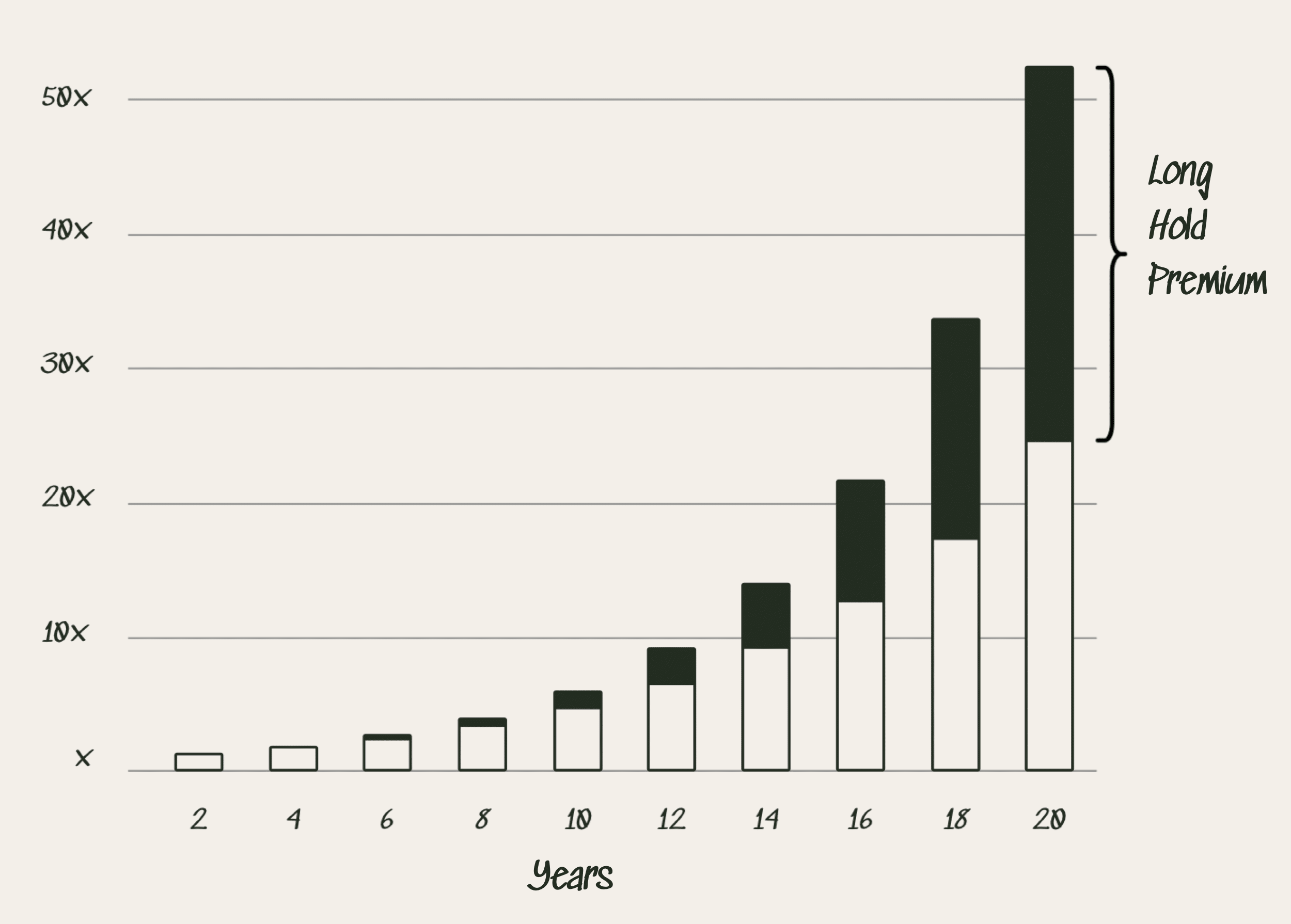

Why Permanent Capital?

An equity-efficient, multi-decade strategy focused on reinvesting and compounding profits can significantly outperform traditional 5-10 year private investment strategies.

Capital Efficient

Tax Efficient

Reduced Reinvestment Risk

Reduced Transaction Frictions

Long-Term Returns

(Multiple of Invested Capital)

Long Hold Advantage:

Four successive 5-year funds returning 25% IRR produce 25x Net MOIC (post tax and carry) vs. 50x Net MOIC (post tax and carry) from a 20-year investment returning the same 25% IRR(2)

Portfolio

B2B industrial services within the broader water industry. Headquartered in Los Angeles, CA.

Regulated, mission-critical B2B services to industrial customers in the Western U.S. Headquartered in Phoenix, AZ.

Contracted, regulated manufacturing and service businesses within Middle America. Headquartered in Austin, TX.

Software operators accelerating growth of legacy B2B SaaS. Headquartered in Park City, UT.

long-term holding company that buys and grows software companies. Headquartered in Bend, OR.

Holding company that acquires and builds leading software and services businesses. Headquartered in New York, NY.

Private American holding company serving software businesses in critical markets. Operating out of Boston, MA and Seattle, WA.

Team

Ross is a Co-founder and Principal at Westerly. Prior to founding Westerly in 2019, Ross was a Vice President at Sycamore Partners, an $8 billion private equity fund in New York, where he invested over $1 billion of equity across three funds.

Ross began his career in the investment banking group at Blackstone, where he advised on transactions in the consumer, real estate, and business services sectors.

Ross received his B.A. summa cum laude, from Yale and his MBA from Harvard Business School. Ross is married with three young children and lives in the Southern Pines area.

Ross is a Board Member of Sylmar, Steel River, Lightbridge and Water Babies.

Rich is a Co-founder and Principal at Westerly. Prior to founding Westerly in 2019, Rich co-founded Six Peak Capital, an active real estate investment and development firm that has acquired over 60 properties across six U.S. markets since its inception.

Rich began his career as an operator, co-founding a venture-backed business while in college, which was sold in 2012. He then went on to co-found or advise several businesses within a self-funded startup studio, collectively valued at over $1 billion.

Rich earned his B.A. from Yale, where he was a four-year member of the varsity crew team and awarded Academic All-Ivy honors. Rich is married with two young kids and lives in the Boston area.

Rich is a Board Member of Sylmar, Evermore and Board Observer at Steel River and Solan Software Group.

Luke supports acquisitions, diligence, reporting, and market research efforts across the Westerly portfolio.

Before joining the Westerly team in 2023, Luke worked in corporate development and FP&A for SGA Dental Partners, a private-equity backed healthcare company.

Luke received his B.B.A. from the University of Georgia.

Ross is a Co-founder and Principal at Westerly. Prior to founding Westerly in 2019, Ross was a Vice President at Sycamore Partners, an $8 billion private equity fund in New York, where he invested over $1 billion of equity across three funds.

Ross began his career in the investment banking group at Blackstone, where he advised on transactions in the consumer, real estate, and business services sectors.

Ross received his B.A. summa cum laude, from Yale and his MBA from Harvard Business School. Ross is married with three young children and lives in the Southern Pines area.

Ross is a Board Member of Sylmar, Steel River, Lightbridge and Water Babies.

Rich is a Co-founder and Principal at Westerly. Prior to founding Westerly in 2019, Rich co-founded Six Peak Capital, an active real estate investment and development firm that has acquired over 60 properties across six U.S. markets since its inception.

Rich began his career as an operator, co-founding a venture-backed business while in college, which was sold in 2012. He then went on to co-found or advise several businesses within a self-funded startup studio, collectively valued at over $1 billion.

Rich earned his B.A. from Yale, where he was a four-year member of the varsity crew team and awarded Academic All-Ivy honors. Rich is married with two young kids and lives in the Boston area.

Rich is a Board Member of Sylmar, Evermore and Board Observer at Steel River and Solan Software Group.

Luke supports acquisitions, diligence, reporting, and market research efforts across the Westerly portfolio.

Before joining the Westerly team in 2023, Luke worked in corporate development and FP&A for SGA Dental Partners, a private-equity backed healthcare company.

Luke received his B.B.A. from the University of Georgia.

Let’s Start a Conversation

We would love to learn more about your business or ambitions, what you need, and how we can help:

(1) Net returns assume 20% carried interest and 25% all-in long-term capital gains tax for both fund and long-hold investment; assumes immediate reinvestment of fund proceeds every five years

(2) U.S. Small Business Administration, defined as businesses with 20-500 employees